EVs outsell Diesels in Europe for first time ever

Electric vehicles and plug-in hybrids have together outsold diesels across Europe for the first time in history. In August, according to the latest statistics from analyst JATO Dynamics, EVs and PHEVs claimed a combined market share of 21% of the European new car market. The 151,737 units registered in August represented a 61% year-on-year increase and were 10,100 units higher than the number of diesels sold in the same month.

“This marks an astonishing turnaround in buying habits given that diesel has dominated new car sales for the last decade or more,” said Samuel Kellner-Steinmetz, Chief Sales Officer of Fleet Logistics Group.

The total volume of EVs and PHEVs for the first eight months of the year were 1.32 million units, another new record.

Felipe Munoz, Global Analyst at JATO Dynamics, commented “Although deals and incentives have played a significant part in boosting demand, we have seen a fundamental shift in buying habits as more appealing models have entered the market and consumers have become aware of the benefits attached to EVs.

“This time last year, the volume of EVs was 158,300 units less than diesel car registrations. However, last month we saw these EVs outsell diesel vehicles by 10,100 units. Demand was particularly strong for the electric versions of the Fiat 500, Peugeot 208, Hyundai Kona, Opel Corsa and Kia Niro, in addition to the outstanding results of the Volkswagen ID.3 – Europe’s top-selling EV during the month.”

JATO analysed data for 26 European markets and revealed that new car registrations slowed once again in August, with a year-on-year decline of 18% to 713,714 units – the lowest recorded volume in August since 2014.

However, so far this year the volume of new car sales remains higher than last year when the pandemic was at its height, with 8,095,419 registered units between January and August 2021 compared with 7,192,839 registered for the same period last year.

This is despite the impact on the market of a global shortage in semi-conductors which has had a widespread dampening effect on new car sales.

Felipe Munoz said: “The chip shortage has been a major setback for OEMs still grappling with the effects of the pandemic. Production issues and delays in the delivery of new cars have been damaging to sales, and the lack of availability at dealerships is forcing many consumers to either look for used cars or simply delay their purchase. In usual circumstances, consumers may expect to wait lots of months for a new Ferrari, but they are now experiencing the same delay for regular models.”

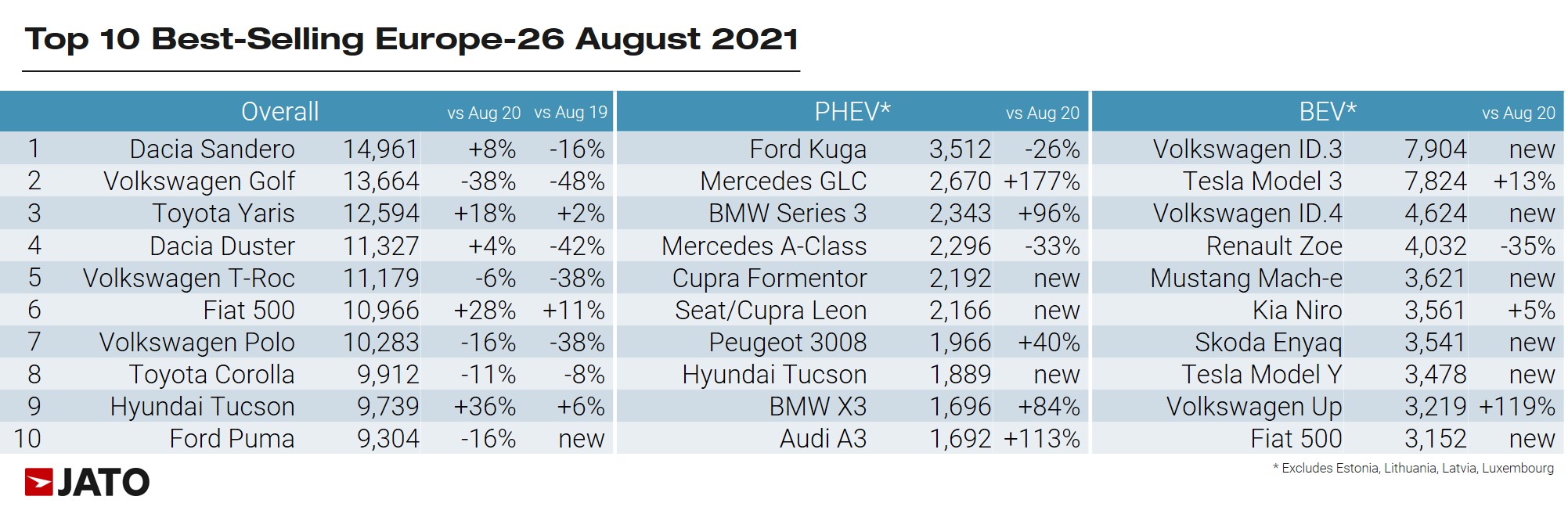

The Dacia Sandero secured the top spot as the most registered car in Europe in August. Despite availability issues, the third generation is proving to be a true success for Dacia. Deals introduced over the course of the year have helped this low-cost subcompact become Europe’s fifth best-selling car during the first eight months of this year.

The Dacia outsold the Volkswagen Golf, in second position, which posted a year-on-year monthly decrease of 38%, but still leads the year-to-date rankings.

Dacia’s Duster also entered the top 5 in fourth position, increasing its volume by 4%. Other notable achievements include the Fiat 500, which was boosted by the EV model, the Hyundai Tucson, and the BMW 3-Series which topped the premium rankings.

Among the latest launches, the much-anticipated Tesla Model Y entered the top 10 of the BEV rankings despite only hitting the market in August.

Alongside this, the Ford Mustang Mach E also made the top ten; the Volkswagen ID.3 occupied the 15th position in the general rankings; Opel/Vauxhall registered 4,900 units of the new Mokka, and Volkswagen followed with 4,600 units of the ID.4.

Citroen registered 4,600 units of the C4; the Cupra Formentor again performed well with more than 4,300 units, followed by the Renault Arkana which registered 4,341 units.