Electric vehicles hit record market share, says JATO

Electric vehicles accounted for a record market share of 18% of all European passenger cars sold in July, while the negative effect of the pandemic continued to ease, with total volumes of new cars sold across Europe down by just 4% year on year.

So said market analyst JATO Dynamics in its latest report on the European new car market which saw the new car sales figures for 27 markets slowly reverting back to normal after several months of decline in registrations due to the Coronavirus.

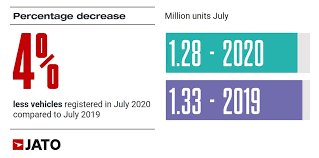

July recorded the highest monthly volume figures so far this year – and the highest since September last year – with the European new car industry registering 1,278,521 new passenger cars, down by only 4% month on month from July 2019.

Sales of petrol cars accounted for 52% of the market, down from 59% in July last year, diesel car sales fell from 31% to 28% year on year, but EV sales soared from 8% in July last year to 18% in July this year.

Felipe Munoz, global analyst at JATO Dynamics, said: “If the current situation continues to improve, we could really start to talk about a ‘V’ shaped recovery in the European car industry.”

However, there were still huge uncertainties regarding how and when the pandemic will finally come to an end.

“Volume levels since January fell by 35% to 6.37 million cars. However, in July there were healthy figures in countries such as the United Kingdom, Denmark and France, alongside other small and midsize markets. Much of this boost can be explained by an increased appetite for green cars, and more value offers.

“The increasing demand predominantly favours SUVs, with a wider offering, including more electrified versions,” he said.

The impact of the global pandemic on European economies has clearly increased interest in electrified vehicles, and July was a record-breaking month for EV registrations with volumes up 131% year on year to 230,700 – the first time that 200,000 EVs were sold in a single month.

As a result, EVs accounted for 18% of total registrations in July, compared with a market share of 7.5% in July 2019 and 5.7% in July 2018.

“The rise in demand for EVs is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices,” said Munoz.

Half of these cars were powered by a hybrid engine (HEV), with demand for this type of vehicle soaring by 89% helped by strong performances from the mild hybrid versions of the Ford Puma and Fiat 500.

Sales of plug-in hybrids (PHEV) were up by 365% from July 2019, boosted by new models like the Ford-Kuga, Mercedes A-Class, BMW XC40 and BMW 3-Series.

Meanwhile, sales of pure electric cars (BEV) also showed encouraging results. Registrations jumped from 23,400 units in July 2019 to 53,200 just one year later, while the number of new models increased from 28 to 38, including the Peugeot 209, Mini Electric, MG ZS, Porsche Taycan and Skoda Citigo.

However, American manufacturer Tesla posted a 76% decline to 1050 units following shipping delays to Europe, and as a consequence of production challenges at its Fremont, California plant.

Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe. Some of this can be explained by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

New car buyers’ love affair with SUVs continues with record results, and accounting for almost 42% of total registrations to 530,800 units, highest monthly volume since July 2019.

“SUVs are usually more expensive than their car equivalents, so it is remarkable to see that despite the crisis, this is the only segment that has seen growth. They prove that with a competitive offer, buyers respond positively, despite the difficulties,” said Munoz.

Full details can be downloaded here

If you require any further information or advice on this topic, please contact info@fleetlogistics.com.